STRAITS TIMES

Nov 25, 2010

<iframe src="http://docs.google.com/gview?url=http://160.96.186.100/lib/pdf/2010/Nov/ST2515.pdf&embedded=true" style="width:600px; height:500px;" frameborder="0"></iframe>

http://160.96.186.100/lib/pdf/2010/Nov/ST2515.pdf

Showing posts with label LCC. Show all posts

Showing posts with label LCC. Show all posts

Monday, September 5, 2011

Wednesday, August 31, 2011

Flying straight into the competition

Karamjit Kaur

The Straits Times

Publication Date : 19-08-2011

The Straits Times

Publication Date : 19-08-2011

Australian

airline Qantas is looking at either Singapore or Kuala Lumpur as the

base for a new premium carrier it plans to launch.

Its decision either way will have an impact not only on rival Singapore Airlines (SIA) and local carriers, but on the hub status of Singapore's Changi Airport. Qantas' new start-up is among several initiatives to boost business and salvage its loss-making international operations. Chief executive Alan Joyce has not disclosed much about it. What is known is that the new entity will be a separate brand from Qantas' distinctive flying kangaroo, and will kick off with a fleet of 11 single-aisle Airbus 320 aircraft. Many aviation watchers think Qantas will pick Singapore. But KL's appeal cannot be dismissed either. In some ways, Singapore is the obvious choice because Qantas and its low-cost arm Jetstar, is already the largest single foreign player at Changi, accounting for about 10.5 per cent of the total number of weekly seats. The SIA group, including regional airline SilkAir, controls 40 per cent of the market. Singapore is also a key hub for Qantas on the Australia-Britain route. In contrast, Qantas does not fly direct to KL. Picking Singapore would allow the new Qantas carrier to leverage on Changi Airport's position as a hub for premium and business travellers, and let it tap Changi's network of over 100 airlines operating to more than 200 cities. Kuala Lumpur International Airport is served by about 60 carriers. But there are also sound arguments in favour of KL being the base of the new carrier. For one thing, it allows Qantas to deepen existing partnerships with AirAsia and full-service carrier Malaysia Airlines (MAS). In January last year, AirAsia and Jetstar inked a deal to pool resources and expertise in a drive to slash costs and lower ticket prices. More recently, Qantas sponsored MAS' entry into the Oneworld global aviation alliance, which includes Qantas, British Airways and Cathay Pacific. This allows Qantas, which has a limited presence in Asia, to leverage on MAS' network to expand its own reach. But business links between the Qantas family and the MAS family do not necessarily mean that the Australian carrier should plant its new flag in KL. Flying out of KL could be counter-productive as the new entity could take away market share from the local players. By the same token, a new Qantas arm in Singapore that targets the premium market is going to hurt SIA and its regional carrier SilkAir. Already, SIA's market share and yields have eroded in recent years, in the face of competition from regional budget carriers and improved service from full-service airlines like Emirates and Cathay Pacific. A new Qantas-backed carrier flying out of Singapore will intensify the heat on SIA. SIA is already preparing for a more competitive skyscape. It plans to launch its own long-haul low-cost carrier by the middle of next year. It recently struck a deal with Virgin Australia to code-share - sell seats on each other's services - and coordinate flight schedules for seamless transfers. Whether its preferred choice is Singapore or KL, Qantas will need the official nod from the relevant civil aviation regulator to launch its new carrier. If Qantas wants to fly its new carrier out of Singapore, the Civil Aviation Authority of Singapore (CAAS) must scrutinise what value the new carrier will bring to Singapore. How will the new carrier enhance Singapore's position as a premier air hub in the region and make Changi more attractive to both airlines and travellers? Will the new carrier launch new routes and markets? Or is the intention merely to snatch market share away from SIA and other incumbents that fly out of Singapore? CAAS will have to strike a balance between promoting Changi as an air hub, and safeguarding the interests of existing airlines, including SIA, that fly out of Singapore. Its assessment must be guided ultimately by what is best for the country. Unlike some other countries reluctant to open their skies to foreign carriers for fear of weakening their own local airlines, the Singapore Government has always adopted a liberal stance. Having more airlines and linkages out of Singapore makes Changi attractive to travellers, and promotes business links and overall economic growth. The interests of SIA and other local airlines sometimes have to take a back seat to this paramount objective. This was a position then Senior Minister Lee Kuan Yew reiterated when he got involved in a dispute between SIA and its pilots several years ago. He had declared in January 2004 that if budget airlines were to eat into SIA's profits, his reaction would be: "So be it". This was because the more important objective was "our remaining a busy air hub". This of course does not mean that the Government does not push for SIA's rights and that of other local carriers. When air deals are sealed between countries, these are often the end result of delicate manoeuvring, with one eye on the commercial interests of the country's carrier/s and the other on the wider benefits that increased traffic will bring to that country. The ideal scenario from Singapore's point of view would be for the Australian carrier to fly out of Singapore in return for SIA getting air rights between Australia and the United States which it has long lobbied for. But even if no such deal is struck, CAAS should consider an application from Qantas on its own merit. If satisfied that Qantas' new arm will benefit Changi Airport and Singapore's aviation industry, then it must say yes to the kangaroo, even if it hurts Singapore's national airline SIA. But even that need not be a zero sum game. In fact, one can argue that SIA's success to date is due in part to the airline having to constantly upgrade and improve its services and products to deal with the competition. To its credit, SIA has risen to the challenge. There is every chance it will do so again, even if Qantas is allowed to plant its new flag at Changi. |

Wednesday, May 25, 2011

SIA to form long-haul low-cost subsidiary

Operations at the Singapore-based wholly-owned subsidiary will begin within a year, and it will be managed separately from SIA, said the Star Alliance carrier.

"The new airline is being established following extensive review and analysis. It will enable the SIA Group to serve a largely untapped new market and cater to the growing demand among consumers for low-fare travel," added the airline.

This is the airline's first major decision under new CEO Goh Choon Phong, who took over the reins at SIA on 1 January and has largely kept a low profile while reviewing the carrier's medium to long-term strategy.

"We are seeing a new market segment being created and this will provide another growth opportunity for the SIA Group," he said. "As we have observed on short-haul routes within Asia, low-fare airlines help stimulate demand for travel, and we expect this will also prove true for longer flights."

The company remains committed to its flagship airline's premium model, and this new subsidiary will supplement the existing businesses, he added. "We remain fully committed to the further growth of SIA, which will continue to offer the highest-quality products and services to our customers."

Kuala Lumpur-based AirAsia X, in which Malaysian low-cost carrier AirAsia has a 16% stake, pioneered the long-haul low-cost model in Southeast Asia and has gradually grown since it began operations in November 2007. Its network now includes London, Paris, Tehran, Gold Coast, Melbourne, Christchurch, New Delhi, Mumbai, Chengdu, Tianjin, Hangzhou, Taipei, Seoul, Tokyo and Perth.

From Singapore, Qantas associate Jetstar Asia flies Airbus A330s long-haul to Melbourne and Auckland. It also plans to offer services to Japan and points in Europe in the near term.

Details related to the new airline's branding, products and services, and route network will be announced by its management team "in due course", said SIA.

Aircraft will initially be sourced from the parent carrier, which has 20 Boeing 787-9s and 20 Airbus A350-900s on order. SIA's spokesman said that subsequently, "all options are open on aircraft sourcing".

He added that there could be routes on which both the parent airline and the new subsidiary could operate on, although this will be decided by the management team.

SIA's regional airline SilkAir will retain its business model, he said. "SilkAir is a network carrier while this subsidiary will have a point-to-point model," he added.

http://www.flightglobal.com/articles/2011/05/25/357171/sia-to-form-long-haul-low-cost-subsidiary.html

Singapore Air to set up low-fare long-haul carrier

Wed May 25, 2011 7:42am EDT

* New carrier to operate within one year* To use wide-body planes for medium, long haul

* Move comes as competition increases from budget airlines

* AirAsia boss dismisses threat from new carrier

(Adds AirAsia chief executive)

By Harry Suhartono and Charmian Kok

SINGAPORE, May 25 (Reuters) - Singapore Airlines (SIAL.SI), the world's second-most valuable listed airline, set out plans to enter the long-haul budget carrier market by setting up a new subsidiary expected to compete with AirAsia X.

The premium carrier faces competition from other players in Asia and the Middle East that cater to high-end passengers as well as fast-expanding budget airlines in Asia.

Wednesday's move by Singapore Airlines' new Chief Executive Officer Goh Choon Phong marks a major reversal from his predecessor's strategy.

"This is driven by the changing landscape in the industry. If you look at what's happening (in Malaysia), AirAsia X has really made leaps and bounds in terms of their operations," an aviation analyst at Standard & Poor's, Shukor Yusof, said.

"It's a new direction and it's been driven by a need for them to grow within the market," he said.

Singapore has built its reputation on high-quality cabin service.

Goh's predecessor Chew Choon Seng had questioned whether the budget carrier strategy could be successfully applied to long-haul routes, noting that passengers on 13-hour flights would expect to be served meals and enjoy some degree of comfort and entertainment.

"As we have observed on short-haul routes within Asia, low-fare airlines help stimulate demand for travel, and we expect this will also prove true for longer flights," said Goh, who has been in the top job for about six months.

The carrier controls about a third of Singapore-based budget carrier Tiger Airways (TAHL.SI), which mostly operates on short-haul routes, and owns regional carrier SilkAir.

AirAsia X is the long-haul budget carrier unit of Malaysia's AirAsia (AIRA.KL).

AirAsia Chief Executive Tony Fernandes dismissed the new threat.

"Not worried. They should be worried. Their p and l (profit and loss statemwent) going to hurt. Business(es) should stick to what they know best," he said on Twitter.

Fernandes is in the midst of negotiating a major deal with Airbus (EAD.PA) that could include more long-haul A330 passenger jets for AirAsia X as well as medium-haul A320neo aircraft.

Singapore Airlines, 55 percent owned by state investor Temasek Holdings [TEM.UL], had said near-term weakness in load factors and high fuel prices are the top threats for the carrier and will affect its operating performance.

http://www.reuters.com/article/2011/05/25/singaporeairlines-idUSL3E7GP1HE20110525

Thursday, March 10, 2011

Tuesday, January 25, 2011

The cost structures of network airlines and low-cost carriers may not be as different as they once were

Wednesday 14, July 2010

http://www.travelio.net/the-cost-structures-of-network-airlines-and-low-cost-carriers-may-not-be-as-different.html

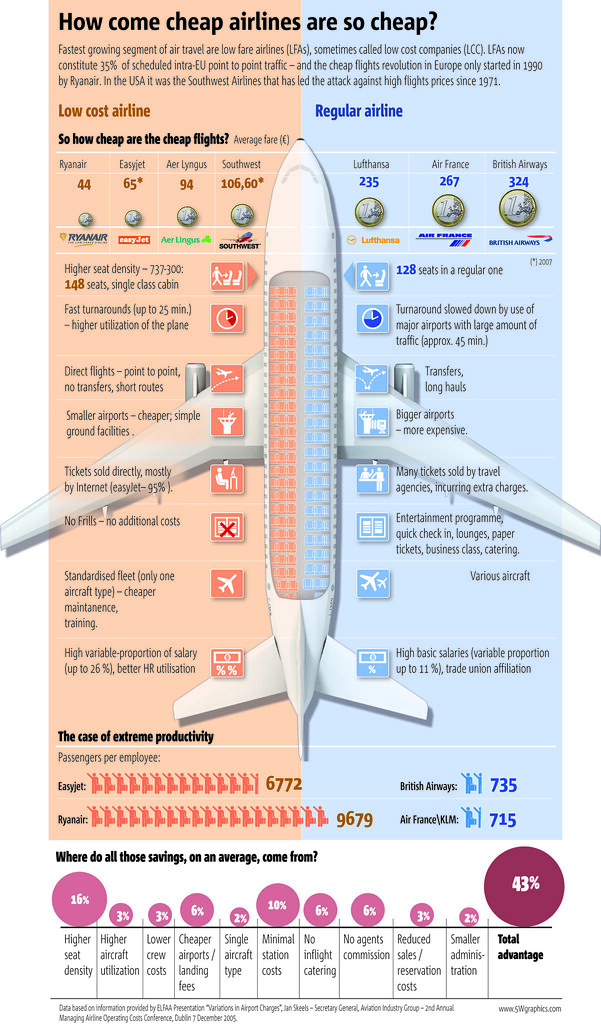

Once, low-cost carriers (LCCs) looked set to become the dominant force in aviation. Many still believe that to be true. But the response of legacy airlines is no longer as muted as it was—and LCCs are not as low cost as they were.

http://www.travelio.net/the-cost-structures-of-network-airlines-and-low-cost-carriers-may-not-be-as-different.html

Sunday, January 23, 2011

AirAsia.com

AirAsia.com

Professional Diploma Program in Logistics and Supply Chain Management Project Studies – Enabling Technology in Airline Industry

By

WONG Pui Man, Cary

March 2009

CONTENTS ..............................................................................................................................................................2

ABSTRACT..............................................................................................................................................................3

COMPANY BACKGROUND..................................................................................................................................4

BUSINESS PROCESS AND OPERATION..........................................................................................................5

LOW COST CARRIER (LCC) BUSINESS MODEL...............................................................................................7

BUSINESS MODEL.............................................................................................................................................7

COMPETITIVE ADVANTAGES .........................................................................................................................8

SWOT ANALYSIS...............................................................................................................................................8

MAJOR CHALLENGES ......................................................................................................................................9

VALUE CHAIN ANALYSIS ...............................................................................................................................9

IT IMPLEMENTATIONS AND STRATEGIC ALIGNMENT..............................................................................10

CURRENT STRATEGIC IT IMPLMENTATION .............................................................................................10

POTENTIAL STRATEGIC IT IMPLEMENTATION........................................................................................11

REFERENCES........................................................................................................................................................14

Professional Diploma Program in Logistics and Supply Chain Management Project Studies – Enabling Technology in Airline Industry

By

WONG Pui Man, Cary

March 2009

CONTENTS ..............................................................................................................................................................2

ABSTRACT..............................................................................................................................................................3

COMPANY BACKGROUND..................................................................................................................................4

BUSINESS PROCESS AND OPERATION..........................................................................................................5

LOW COST CARRIER (LCC) BUSINESS MODEL...............................................................................................7

BUSINESS MODEL.............................................................................................................................................7

COMPETITIVE ADVANTAGES .........................................................................................................................8

SWOT ANALYSIS...............................................................................................................................................8

MAJOR CHALLENGES ......................................................................................................................................9

VALUE CHAIN ANALYSIS ...............................................................................................................................9

IT IMPLEMENTATIONS AND STRATEGIC ALIGNMENT..............................................................................10

CURRENT STRATEGIC IT IMPLMENTATION .............................................................................................10

POTENTIAL STRATEGIC IT IMPLEMENTATION........................................................................................11

REFERENCES........................................................................................................................................................14

Friday, December 31, 2010

Strategic and execution failures make AirAsia scale back India operations

Earlier this year, many an Indian waited with expectation while all Indian carriers waited with trepidation as the Malaysian low cost behemoth AirAsia, announced and commenced flights to a slew of cities across the nation.

Fast forward six months, and the Indian carriers are breathing easy as AirAsia is quietly withdrawing or dramatically scaling back flight operations from many Indian cities. Hyderabad, Bangalore, Kolkata, Trivandrum, are just a few, even the Chennai-Penang flight where the carrier has a complete monopoly has been quietly withdrawn. No seats are available for booking as much as one month in advance, even though the flight is still officially listed on the time-table.

What caused this low fare juggernaut to falter in a value concious country like India? A market so well suited for a low cost carrier, a market in which domestic low fare carriers are doing so well. It appears to be a combination of an incorrect strategy married to poor execution and a failure to adapt the AirAsia business model to meet the expectations of the Indian passenger.

Not engaging travel agents

Unlike domestic travel, foreign travel involves a variety of services in addition to the air ticket. From passports, visas, hotels, tours, to insurance, there is a gamut of services travellers need when flying overseas, and for these they rely on the travel agent. Travel agents are responsible for over 83% of the international travel bookings.Even the largest global carriers like Singapore Airlines and Lufthansa realised the power of the travel agent in the Indian market when they tried to impose a zero commission regime and were met with stiff resistance.

The typical passenger on AirAsia would be a first time international traveller, and not well versed with the myriad of documentation and other requirements of foreign travel. many carriers and choices available in the travel market. Unlike Indian low fare carriers SpiceJet and IndiGo, AirAsia has chosen not to engage the travel agents, instead relying on a single call centre.

Ignoring corporates

The Chennai Penang route is a perfect example of the airline's failure to engage with potential customers business. Even with a monopoly on this route, AirAsia was managing a woeful 50% passenger load factors.There are strong social and business links between the two cities. Penang was the base for the British during colonial times and was the destination of choice for Indian immigrants primarily from the state of Tamil Nadu whose capital is Chennai, since the late 18th century. There are similar synergies in business as well. Penang is one of the largest electronics manufacturing areas in the world, and Chennai is the hub for electronics manufacturing in India. Dell, Flextronics, Jabil, Sanmina SCI, Nokia, Bosch, the list of potential customers, with facilities in both cities, is endless.

Time is valuable for everyone especially the business traveller. I used to fly this route regularly as it was a simple three hour day flight instead of a eight hour overnight ordeal via Kuala Lumpur, yet, I was probably the only business customer on the flight.

Visa pains

AirAsia' point to point model works against it, since Kuala Lumpur and Malaysia are not the final destination for many Indian travellers, and multiple tickets cause confusion for the first time and uninitiated traveller.

The decision of the Malaysian government to remove the visa on arrival facility has also hurt the carrier significantly since most passengers will not want to go through the travails of obtaining a Malaysian visa purely for transit, and after tickets, visas are the foremost services travellers obtain from travel agents, a segment AirAsia does not engage with.

Over-estimation of the AirAsia brand and model

AirAsia may be a household name in Malaysia, but not in India. The airline has chosen to rely more on word of mouth instead of advertising, and therefore remains relatively low on the recall level when someone wishes to travel.With different value perceptions and expectations, the Indian market is not yet ready for a traditional low-cost carrier with the complete a-la-carte pricing. AirAsia has to learn the finer market nuances from Indian low cost carriers IndiGo, SpiceJet, and GoAir who have spent the last five years building a trust with their passengers. Recent incidents like the Delhi fiasco only lower the airline's brand equity.

To avoid being stuck with only the elderly or labour class passengers, it is important for AirAsia to develop a loyal clientèle of business and middle-class leisure travellers, and for that it needs to engage with them via advertising, brand-building, and the travel agent community.

IndiGo which has a no-fuss service model very similar to AirAsia has recognised the weakness of this model for its upcoming international operations and is modifying it to ensure success.

Impatience

AirAsia runs a very tight ship and expects quick results. Its skeleton teams in various cities are too busy running airport operations to network with potential clients and build business.

AirAsia also need to give its teams longer than the six months, before it downgrades or kills the route or its employees.

India has long been the graveyard of low cost international carriers. Jetstar Asia, Tiger Airways, Nok Air, and others have come, failed, and quietly left the Indian market. Much is expected of AirAsia, and the carrier has excellent business leaders, but if they repeat the mistakes of their predecessors they are doomed to the same failed results.

http://www.bangaloreaviation.com/2010/12/strategic-and-execution-failures-make.html

Sunday, October 3, 2010

Wednesday, June 9, 2010

Sunday, June 6, 2010

Singapore Changi embarks on its 21st century makeover

http://www.centreforaviation.com/news/2008/03/07/singapore-changi-embarks-on-its-21st-century-makeover/

Key Points:

- Changi’s Budget Airport to be upgraded, plans for a fourth terminal and further upgrade of Terminal One and corporatisation for CAAS proceeding (slowly);

- Part of a process of re-engineering for the new global environment;

- Threats not only from major hubs, but also from LCC expansion at KLIA;

- Conservative attitudes mean that corporatisation comes slowly

Enhancing Our Air Hub Status

http://app.mot.gov.sg/data/s_08_03_06a.htm

talking about:

SPEECH BY MRS LIM HWEE HUA,

MINISTER OF STATE FOR FINANCE AND TRANSPORT,

ON AIR TRANSPORT

AT THE COMMITTEE OF SUPPLY DEBATE,

ON 6 MARCH 2008

- continue to push for the liberalisation of the aviation regime

- build capacity to keep ahead of growing demands, and

- measures to encourage airlines to come to Singapore

Wednesday, June 2, 2010

Jetstar teams up with Air France KLM

http://blogs.crikey.com.au/planetalking/2010/06/02/jetstar-teams-up-with-air-france-klm/

Monday, May 31, 2010

Codesharing - Low-cost alliances: never say never

http://www.flightglobal.com/articles/2007/08/21/216174/low-cost-alliances-never-say-never.html

FlightGlobal - Interlining, Worth the effort?

http://www.flightglobal.com/articles/2007/01/22/211716/worth-the-effort.html

FlightGlobal - Low-cost carrier codeshares: slow to take off

http://www.flightglobal.com/articles/2009/08/19/331205/low-cost-carrier-codeshares-slow-to-take-off.html

Despite all the hype about low-cost carriers rapidly moving into codeshares, there are fewer doing it today than there were two years ago. What has happened? Are there less expensive and complex alternatives worth pursuing?

Despite all the hype about low-cost carriers rapidly moving into codeshares, there are fewer doing it today than there were two years ago. What has happened? Are there less expensive and complex alternatives worth pursuing?

Sunday, May 30, 2010

Airline FFPs remain strong marketing tools

http://www.flightglobal.com/articles/2010/03/24/339881/airline-ffps-remain-strong-marketing-tools.html

It's official: airline seats remain the most powerful currency in the world of customer loyalty. That was one of the overriding conclusions of the Airline Business/Global Flight Loyalty 2010 event held in Kuala Lumpur in February and it was no small comfort to the industry's leading airline frequent flyer programme experts gathered to debate the future of their corner of the air transport business.........

It's official: airline seats remain the most powerful currency in the world of customer loyalty. That was one of the overriding conclusions of the Airline Business/Global Flight Loyalty 2010 event held in Kuala Lumpur in February and it was no small comfort to the industry's leading airline frequent flyer programme experts gathered to debate the future of their corner of the air transport business.........

Thursday, May 20, 2010

INTERVIEW with : SIA CEO Chew Choon Seng

http://www.flightglobal.com/articles/2010/01/21/337362/interview-singapore-ceo-chew-choon-seng.html

Subscribe to:

Posts (Atom)